Stock market trading involves many different types of risk. Some of these risks are inherent in the market itself, while others are specific to individual stocks or investment strategies. Therefore, it is very important to understand all the different types of risks before making any investment decisions.

Stock market turbulence

Stock drop

Low yield return

Think about which brand to choose

Many day traders love penny stocks because they can move 20%, 50% or more during the day!

“Why buy penny stocks”?

1、Low barriers to entry: Penny stocks usually have low share prices, which makes it possible for some small investors to buy shares. Penny stocks require less capital to buy than high-priced stocks, which can be a good entry point for novice investors who are just getting started.

2、High Liquidity: Due to the low price of penny stocks, their trading volume is relatively high, so the trading is more active and the liquidity is better. For short-term investors or investors who need to buy and sell quickly, this can provide better trading opportunities.

3、High ROI: Some penny stocks may be undervalued in the market, but these companies may have potential for growth. Therefore, buying these stocks may provide investors with a high return on investment

Rajiv Jain

Rajiv is the Chairman and Chief Investment Officer of GQG Partners, and serves as the portfolio manager for all GQG Partners strategies. Having over 23 years of investment experience, most notably serving as Co CEO of Vontobel Asset Management (since July 2014) and Chief Investment Officer and Head of Stocks (since February 2002). He was the 2012 Morning Star Fund Manager of the Year. Jain (Rajiv Jain) was born in India but moved to the United States to pursue an MBA in 1990. He co founded GQG Partners in 2016 and has since turned it a giant with a market value of $113 billion. Un many of his peers, Jahn has no account on X (formerly known as Twitter), rarely appears on television, and has little interest in autonomous car companies or hypersonic missile manufacturers. On the contrary, he bought industries with a clear 20th century style: energy, tobacco, and banking. GQGs Indian stock investment portfolio also reflects this. Jahns company has purchased more Indian stocks and downplayed the corporate governance and political risks affecting Adani Group. As of the end of October 2023, a total of 9 GQG funds (including mutual funds, collective investments, and managed funds) had an investment value of $14.5 billion in India, accounting for approximately 20% of their total assets under management. However, detailed information on the investment portfolios of only six funds is available, and their investments in India have surged by 125% since last year. Jain is famous for his love of safe and defensive stocks. And make huge bets on these stocks,

“What should you do to avoid risks to a greater extent? ? ? We will help you with the following”

We use three specific parameters to find the penny stocks that are most likely to make big gains.

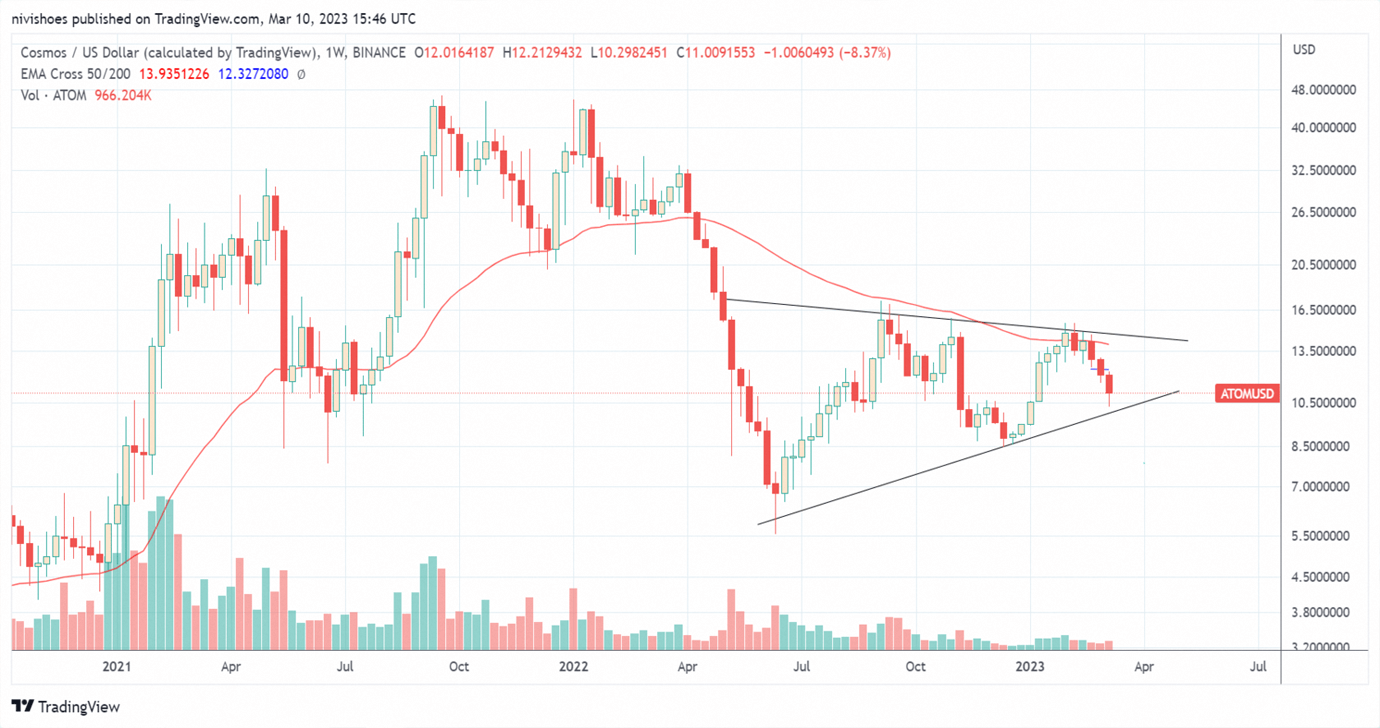

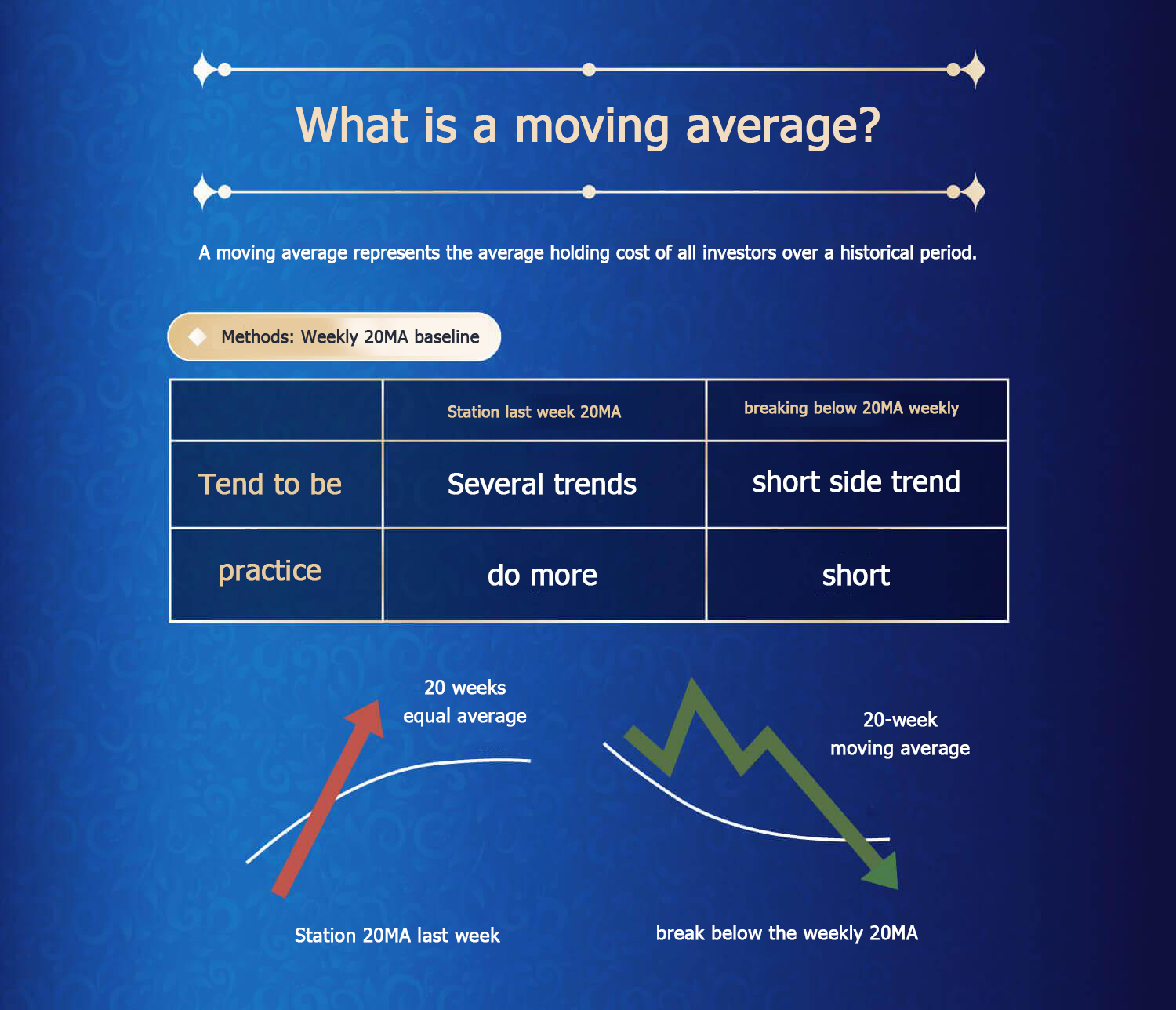

Parameter 2: Technical Indicators - It's essential to look at technical indicators such as moving averages, volume, and RSI. For instance, a stock that has a strong volume and is trading above its 20-day moving average might indicate a bullish trend. Conversely, an overbought RSI could suggest a potential sell-off in the near future.

Expert one-on-one online guidance and teaching

Share day trading strategies, momentum

trading, reversal trading

Daily pre-market trading analysis,

optimized automatic allocation,

trend reversal warning

We've given you a sample of penny stock alerts and possible trades below, based on community expert advice and a penny stock screener.

In the screenshot above, you can see that the penny stock screener with multi-strategy window shows his excellent chart technical analysis ability and stock market forecasting ability, and he will issue alerts in time to help you plan ahead in the stock market!

The 1-hour chart above shows a pullback over the next few days, never trading below the alert day low. Therefore, it is safe to buy on dips around the $2.26 area.

By the next Friday (21st April) the stock hit a high of $79.4 ($45.<> earlier in the screenshot). Be aware of the high volume on alarm day.

Now you know how to find good penny stocks. You've seen some good penny stock investing strategies. You have many more options to try.

If you want to consider choosing higher-quality stocks, you can join our community for detailed consultation and understanding. We will share our investment experience and trading strategies without reservation, Take you to know more secrets of penny stocks, help you find the penny stocks that suit you, and take you to play the penny stock market!

SMC Global Securities Limited

SMC, founded in 1990, is a diversified financial services company in India that provides brokerage services for asset classes such as stocks (cash and derivatives), commodities and currencies, investment banking, wealth management, third-party financial product distribution, research, financing, and custody services for businesses, institutions, high net worth individuals, and other retail clients, insurance brokerage (life and non life), and liquidation services Mortgage loan consulting and real estate consulting services.

About SMC Global Securities Limited SMC Global Securities Limited was founded in 1994 and is one of the trusted and award-winning financial services companies in India. The company operates in over 450 cities in India through a strong network of 2680 sub brokers and 94 branch offices. It also has an experienced and high-quality team of approximately 4000 employees, capable of meeting the financial and investment needs of approximately 2 million clients. If you want to consider choosing higher quality stocks, you can join our community for detailed consultation and understanding. We will unreservedly share our investment experience and trading strategies, take you to know more secrets of penny stocks, help you choose penny stocks that suit you, and play the stock market.